|

||||||||

In this Issue |

October 2017 Edition |

|||||||

State News & EventsLegislative Update - George Klaetsch Chapter News & EventsAsk the Realtor Panel Event - Madison |

WMBA Members, On Thursday, October 19th the WMBA held its 3rd Annual Best in Business Awards Event. We had 215 well-dressed attendees with us to celebrate the evening. 18 different individuals received awards in a grand ceremony in front of their peers. Here’s a recap of this year’s winners  We also announced the date for the 44th WMBA Annual Real Estate Conference. The conference will kick off on the evening of Monday, April 16th with the host of speakers and presenters set for Tuesday, April 17th.  The event will take place at the Hyatt Hotel in Downtown Milwaukee. The event will take place at the Hyatt Hotel in Downtown Milwaukee.

Thank you for your membership!  Joe Doyle WMBA President 2017-2018

Legislative Update - George Klaetsch

WMBA Legislative Focus – Foreclosed Property Sales & Appraisal Management Companies |

|||||||

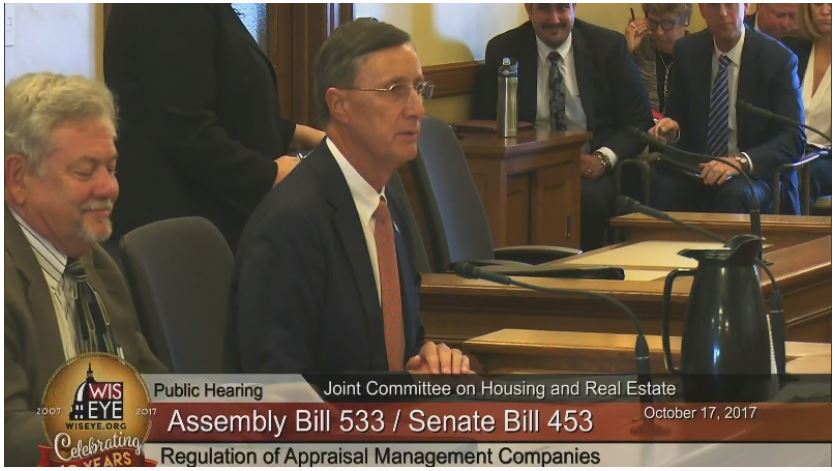

Click the image above to view Ken's testimony. Ken's testimony begins 1:44:22.

|

Both AB 533 and SB 453 were introduced, received a public hearing and were passed out of both the respective Assembly and Senate Committees.

As of this writing, the companion bills were expected to be scheduled on the Assembly and Senate floors during the November 1-9 floor period.

A special thanks to WMBA Legislative Committee Co-Chair, Ken Dickson for providing testimony on behalf of WMBA before the joint committee members.

Return to Top

Best in Business Recap and Photos

On October 19, 215 attendees came together in Madison at the Concourse Hotel for the 3rd Annual Best in Business event. It was quite an evening to celebrate the mortgage banking industry. Thank you again to our sponsors!Photos from the evening are now available - click here.

Return to Top

Equifax Credit Breach

A CFPB link is posted on the home page of the WMBA website. Please feel free to use this and share the information with your customers.Link: Identity Theft Protection Following the Equifax Data Breach

Return to Top

|

Madison Chapter Event

Ask the Realtor - Panel Event

November 9, 2017

Coliseum Bar

Cost: $15

1:30 Registration

2:00 Panel

4:00 Cash Bar

Registration deadline November 2, 2017

Return to Top

Milwaukee Chapter Events

November Monthly Social

November 8, 2017

Ground Round

5:00-7:00 p.m.

Registration deadline November 7, 2017

Annual Holiday Party

December 14, 2017

Dominic's Sports Bar

Albanese's Roadhouse

5:00-9:00 p.m.

Cost: $25 members, $35 non-members

Registration deadline December 4, 2017

Return to Top

|

|

Arch MI and CMG Foundation Presented with MBA Opens Doors Foundation Community Champion Award

The Mortgage Bankers Association (MBA) announced that Arch Mortgage Insurance and the CMG Foundation are the recipients of the MBA Opens Doors Foundation (ODF) 2017 Community Champion Award. The award recognizes those whose dedication resulted in unique and lasting contributions to advance the foundation's mission to enable families with a critically ill or injured child to keep their home, even in the face of significant medical bills."This year the Foundation is honoring a pair of companies- Arch MI and the CMG Foundation- whose collective efforts span multiple years and set high standards for active, innovative support of the Opens Doors mission," said Debra W. Still, CMB, President and CEO of Pulte Mortgage and Chairman of the Foundation's Board of Directors. "Both have shown exceptional leadership and worked hard to advance ODF's mission and long-term and sustained growth."

Still continued, "Chris George and the CMG Foundation have stepped up as real champions of MBA Opens Doors for several years. Chris continues to raise awareness of our mission and of the impact we make on the lives of families with injured or critically ill children.

"Arch MI and Andrew Rippert, CEO of Global Mortgage at Arch Capital Group, have been great champions of our shared mission ever since they were recognized as the first MBA Opens Doors Foundation Guardians in 2015, for what remains the largest multiyear gift in our history. Also, Andrew has also taken a personal leadership role in the Foundation, and continues to advance strategies that will ensure long-term, sustained financial resources to support our mission."

MBA Opens Doors is currently able to pass on 100 percent of the donations it receives to families in need of assistance. Potential recipients of the grants are identified through the Foundation's ongoing relationship with children's hospitals in Washington D.C., Boston, MA, Dallas-Fort Worth, TX, Denver, Co, Houston, TX, Northern and Southern California, and now Akron, OH.

MBA Opens Doors is a 501(c)(3) organization, and all contributions are tax deductible. For more information about the Foundation or to make a donation, please go to www.mbaopensdoors.org.

Return to Top

MBA's Stevens To Retire

WASHINGTON, D.C. (October 25, 2017) -Mortgage Bankers Association (MBA) President and CEO, David H. Stevens today announced his plans to retire on September 30, 2018. Stevens will continue to lead MBA until that time. A diverse MBA member search committee has been created and the process to identify candidates for the position will begin immediately.Stevens joined MBA in May 2011. His leadership has restored MBA to its strongest financial health in its 104-year history. The association was rebranded under his direction and membership growth has surpassed expectations consistently year over year.

Additionally, Stevens has guided the association's regulatory and legislative priorities with a unique talent for synthesizing issues and articulating industry impacts which has elevated MBA's voice and influence inside the beltway. In 2011, Stevens was instrumental in creating the MBA Opens Doors Foundation which helps families with critically ill children. Stevens was diagnosed with cancer in 2016.

"With my cancer in remission, focusing on family, friends and staying healthy is my priority," said David Stevens. "This was a difficult decision; it's hard to walk away from supporting an industry that shaped my career. It's been an honor to work with the talented staff, strong leadership and diverse membership of the MBA."

"We all support Dave in his decision," said David Motley, 2018 MBA Chairman. "MBA has never been stronger and is well positioned to manage this transition. Dave has given his heart and soul to MBA for nearly seven years and on behalf of the entire membership, we are incredibly grateful for his leadership."

The search committee is being chaired by MBA immediate past Chairman, Rodrigo Lopez, and is comprised of 12 volunteer MBA members. The nationwide search for Stevens' replacement commences immediately.

Wisconsin Mortgage Bankers Association Online Store

The WMBA and the MBA have teamed up to bring you great access to the education components you need to stay current in the Mortgage Banking Business.

The WMBA and the MBA have teamed up to bring you great access to the education components you need to stay current in the Mortgage Banking Business.For every product purchased through the WIMBA-MBA store the WMBA receives a % back.

Please use the link below to help support our Association!

Wisconsin Mortgage Bankers Online Store

Remember to check back often!